Financial literacy is a topic that’s not just important; it’s essential. It’s so important that Walden University reports that more than 65% of adults in the U.S. may be financially illiterate. Giving your child financial literacy lesson plans at a young age can help them build good credit and make wise financial decisions as they enter adulthood. Financial literacy is especially important for teens because, with their growing independence and adult responsibilities, they need to have a solid grasp of personal finance. If you want your teen to understand what financial literacy is and how it can positively impact their future, then you need to get them into the nitty-gritty details about personal finances from an early age.

Download and Start Your Free Trial of the Safes Parental Control App

Learning about financial literacy at an early age can be challenging because kids aren’t as likely to understand some of the more complex concepts. Despite this, there are many ways that you can introduce your child to the world of personal finance. Let’s look at some of our favorite financial literacy lesson plans for elementary to high school students who want to learn more about money management and investing. If you’ve been searching for ways to get your children interested in learning about money and its importance, then you’re in luck! This blog post can be helpful for both parents and teachers who want to design financial lesson plans for children.

Financial Literacy Lesson Plans for Elementary School Students

There are countless lesson plans that can teach kids about financial literacy at an early age, but one of the best ways to teach them about money is by making it fun. Creating an elementary school classroom economy is a great way to introduce your pupils to the concept of money management, especially if they’ve never had to deal with an allowance or allowance-like system. This lesson plan can also be used to teach kids about the benefits of earning a little bit of money every week and saving it up for something special.

For an elementary school classroom economy, you can create a jar for your pupils to put money in every week. Parents can also give their children other responsibilities in exchange for money, such as cleaning the car or taking out the trash. Keeping your financial lessons fun and exciting will help foster an interest in money management and a sense of responsibility in your child, important skills they’ll need as they grow up.

Financial Literacy Lesson Plans for Middle School Students

For middle school students, you can create an investment curriculum that uses real-world examples, such as stocks and loans, to teach the basic investing principles. You can also teach your students about credit scores and the benefit of paying your credit card bills on time. As your students enter their teenage years, it’s essential to help them understand the importance of credit scores and why it’s crucial for their financial future.

For budgeting lessons, you can create a game that your students can play throughout the year to help them keep track of their spending. You can also create a template that outlines a student’s monthly allowance and how to budget it. It’s essential to help your middle school students understand the concept of budgeting because they’ll need to understand the importance of money management as they begin to take on more responsibility.

Financial Literacy Lesson Plans for High School Students

Depending on your state laws, high school students can begin taking a financial literacy class. These classes are a great way to help your teens understand the basics of money management, including the importance of paying their credit card bills on time, understanding their student loan interest rates, and how to make sound financial decisions in general.

To teach them about insurance, you can create a game that your students can play to help them understand the concept of insurance. This game can be used to explain how an insurance company works, how an insurance claim process works, and what kinds of risks are covered by different types of insurance.

When you, as a teacher, have a high school financial literacy class, you can create a curriculum to incorporate the topics that will be covered in class as well as topics that you want to focus on with your students. You can create a game they can play to help them understand the concept of insurance, such as a game that uses real-life scenarios to teach them about the importance of insurance.

Tips for Best Financial Literacy Teaching

When teaching your student/child about personal finances, it’s essential to keep things simple. Students are much more likely to understand and retain complex financial concepts when they’re taught in a simple manner, so it’s essential to keep things simple when you’re teaching about money. It’s also important to keep your lesson plans fresh and engaging, as students are much more likely to pay attention and retain information when the lesson plan is new, engaging, and different than what they’ve seen before. If, as a teacher, you’re planning on teaching financial literacy in your classroom, make sure to keep it interesting, engaging, and relevant to your students.

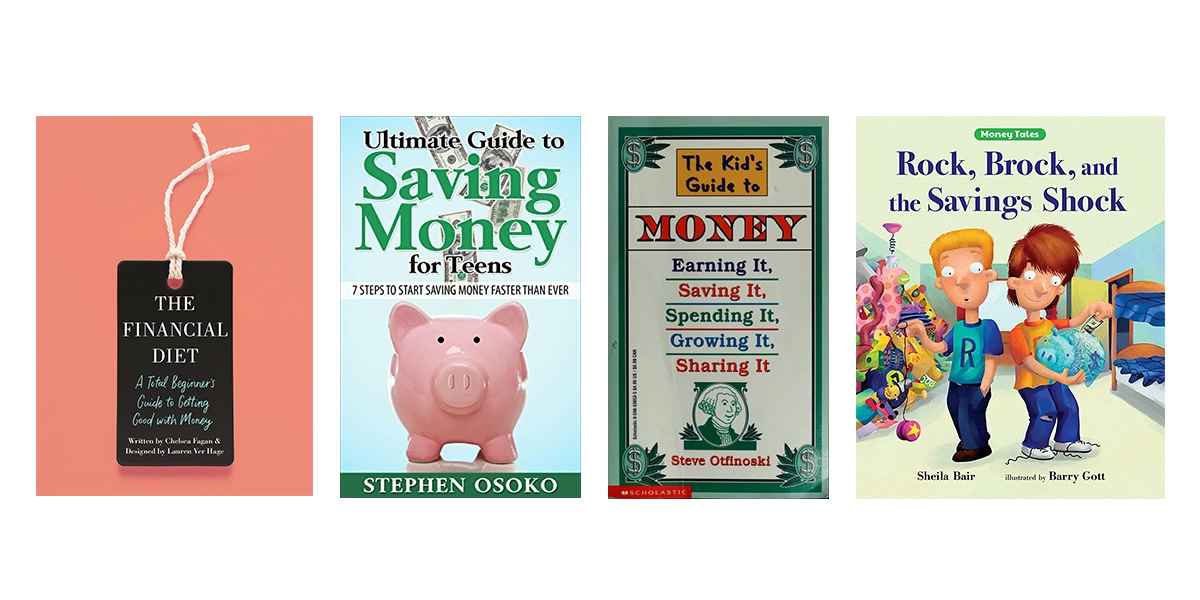

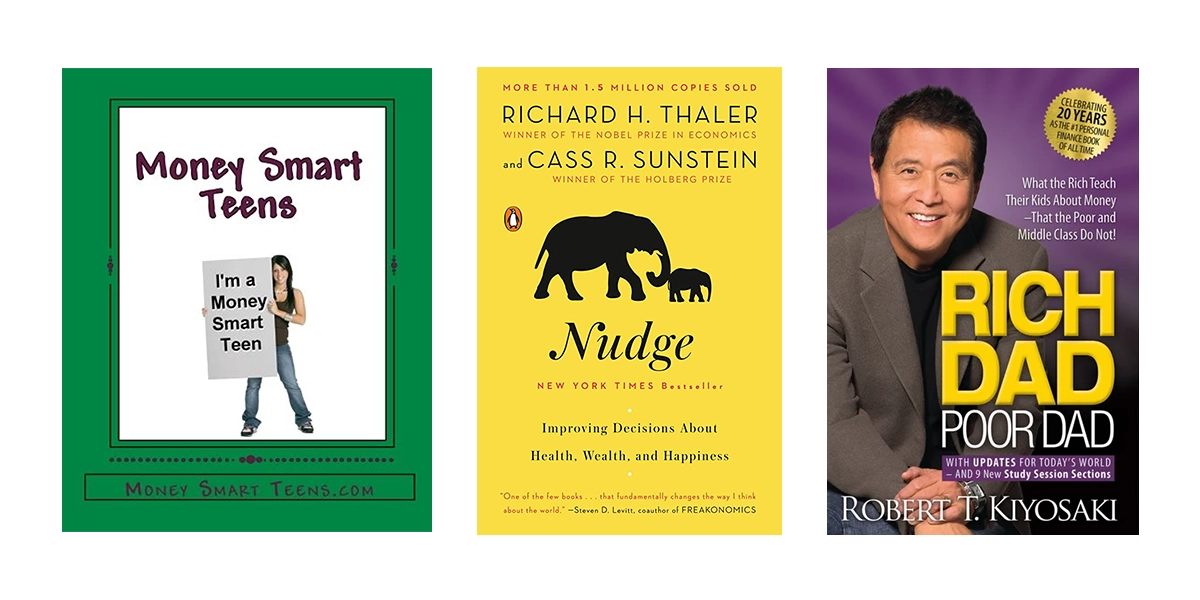

Books that Teach Children of All Ages Financial Literacy

Before and while you implement classroom lesson plans, it’s essential to let your student/child know what financial literacy really is. Financial literacy is the ability to make good decisions with money. It’s not about having a ton of money but knowing how to spend money wisely and protect yourself from debt. One way you can introduce your kids to financial literacy is to get them to read. There are many different books that can help you teach your kids about money, from books like The Financial Diet, which helps readers make a personal budget, to books like Rich Dad Poor Dad, which discuss the importance of saving for retirement.

How Can Safes Help Students Focus on Important Financial Literacy Lessons?

We all know how distracting social media can be, which is why it’s important to limit the amount of time your kids spend on these platforms. Safes parental control app is an app that you can download on both Android and iOS devices and use to limit the amount of time your kids can spend on social media. This helps your kids focus on the important topics that need to be covered in class, such as financial literacy, rather than getting sidetracked by pointless social media likes. This app also monitors your child’s phone usage, so you don’t have to worry about your teens sneaking in minutes on their phones or devices.

Learn more about how Safes saves your child’s valuable time using the links below:

- Windows parental controls

- Macbook parental controls

- Parental controls on Android

- iPhone parental controls

Take advantage of our free trial to experience the benefits firsthand and see how Safes can enhance your child’s focus and productivity.

Conclusion

Financial literacy is something that people need to learn as soon as possible, so it’s especially important for teens to learn this topic. If you want your teen to understand what financial literacy is and how it can positively impact their future, then you need to get them into the details of personal finances from an early age. You can introduce your child to the world of personal finance in many ways, such as creating an elementary school classroom economy and making an investment curriculum.

Your Child’s Online Safety Starts Here

Every parent today needs a solution to manage screen time and keep their child safe online.

Without the right tools, digital risks and excessive screen time can impact children's well-being. Safes helps parents set healthy boundaries, monitor activity, and protect kids from online dangers—all with an easy-to-use app.

Take control of your child’s digital world. Learn more about Safes or download the app to start your free trial today!