As we navigate through the 21st century, the financial landscape has grown increasingly complex, necessitating a higher level of financial literacy. Thus, equipping our children with the right money management skills has become a vital part of their upbringing. Thankfully, technology has made this task easier with a plethora of money apps for kids designed to teach financial literacy in an engaging and efficient manner.

Download and Start Your Free Trial of the Safes Parental Control App

This blog post will explore several of these apps that are perfectly suited to help kids learn about money management. Each of these apps has unique features tailored to engage and educate children about personal finance. They range from budget apps for teens to investing apps for kids, and they all contribute to the broader goal of fostering financial literacy and responsibility from early on.

The Importance of Financial Literacy for Kids

Before we delve into the details of the best money apps for kids, it’s crucial to understand the importance of teaching financial literacy to children. Financial literacy refers to the ability to understand and use various financial skills, including personal financial management, budgeting, and investing.

When children are taught financial literacy, they are equipped with tools that will last a lifetime. These tools include the ability to make informed decisions about money that can help them avoid debt, make wise investments, and achieve financial security.

Moreover, teaching children about money management from a young age fosters a sense of financial responsibility. It helps them understand the value of money, the importance of saving, and the consequences of their spending habits. This early introduction to personal finance can set them on a path to being financially responsible adults.

Choosing the Right Money Management App for Kids

When choosing a money management app for kids, there are several factors that you should consider. These factors include:

Age Appropriateness: The app should be appropriate for the child’s age and level of understanding. Some apps are designed for younger children, while others are more suitable for teens.

Educational Value: The app should provide educational value, teaching kids about money, savings, budgeting, investments, and more.

Engagement: The app should engage the child and make learning about money fun and interesting.

Safety: The app should have features that ensure the child’s safety online. This includes secure logins, privacy settings, and parental controls.

Ease of Use: The app should be easy for the child to use. This includes a user-friendly interface and clear instructions.

Top Money Apps for Kids

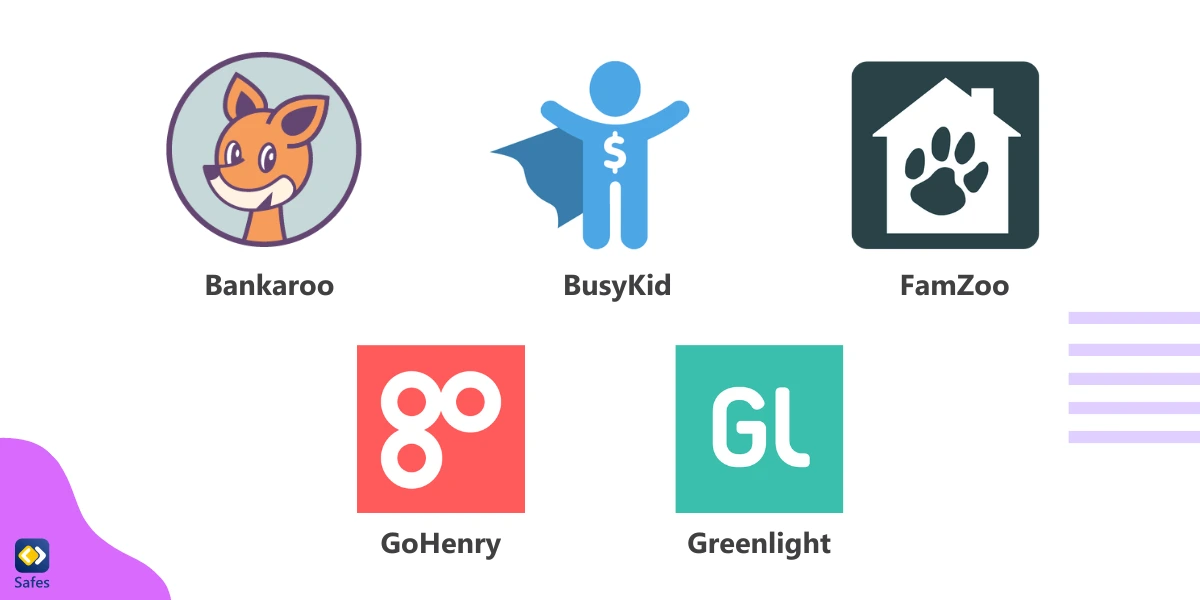

With the factors discussed in mind, let’s explore some of the best money apps for kids that are currently available.

FamZoo

FamZoo is an ideal budget app for teens that operates like a virtual family bank. Parents serve as bankers, while children are customers. Parents can set up regular automated allowance payments, rewards for chores, penalties for missed tasks, and parent-funded interest or matching contributions for saving. This platform allows kids to track chores, spending, saving, and giving, helping them understand how their financial decisions impact their overall funds.

Greenlight

Greenlight is another top-rated app in the world of money management for kids. It provides them with their own debit card while giving parents control over its use. Parents can set spending limits, allocate money for specific categories like food or entertainment, and get real-time notifications of their kids’ spending activities. This app helps kids learn the importance of budgeting and spending responsibly.

Bankaroo

A virtual bank for kids, Bankaroo enables kids to keep track of their earnings and spending. They can also set savings goals and monitor their progress toward achieving them. Parents can add funds, set up an allowance, and track their kids’ financial progress. Although it is not tied to a real bank account, it is a great tool to teach kids about saving and spending.

BusyKid

BusyKid is an allowance and chores app that helps kids learn the value of work and earning money. Parents assign chores and set their worth. Once a chore is completed, the child earns money that can be saved, spent, or donated to charity. The app includes a reloadable Visa debit card, which kids can use to spend their earnings.

GoHenry

GoHenry is another debit card and app combination that allows parents to set spending limits and control over how and where the card can be used. The app has many instructional videos and quizzes that teach children how to manage their money. It also enables kids to set savings goals and learn about earning, saving, and spending responsibly.

Practical Money Lessons for Kids

While money apps for kids can be a fantastic tool to teach financial literacy, it’s important to supplement this digital learning with real-world experiences. Here are some practical ways to reinforce the lessons that money apps impart:

Allocate Weekly or Monthly Allowance

Instead of buying everything for your child or giving them money whenever they ask for it, give them pocket money periodically. Researchers explain, “The main reason for giving pocket money is to help children learn to manage money while they are young and parents can still guide them. Pocket money can help children feel that they are important members of the family because they are given part of the family’s spending money. It helps children to make choices. They learn that sometimes people have to wait and save up to get what they really want.”

Open a Savings Account

Opening a savings account for your child can provide a tangible way for them to see their money grow over time. A savings account can help reinforce the concept of saving and the benefits of earning interest.

Use Cash for Transactions

While digital transactions are becoming the norm, using cash can help children better understand the value of money. Allow your child to pay for items in cash and count the change they receive.

Discuss Household Finances

Involve your child in discussions about household expenses, such as groceries, utilities, and other bills. This strategy can help them understand the cost of living and the importance of budgeting.

Teach Them About Credit

As your child gets older, teach them about credit cards and the concept of debt. Explain how credit cards work, the importance of paying off balances each month, and the potential pitfalls of accruing debt.

Encourage Them to Earn Money

Whether it’s through chores, a part-time job, or a lemonade stand, encourage your child to earn their own money. This can help them understand the value of work and the satisfaction of earning.

Introducing Safes: The Parental Control App

While the money management tools for kids discussed in this blog are designed with safety in mind, it’s important to remember that children are still vulnerable online. The Safes parental control app can be a great addition to your child’s digital toolkit, as it helps you monitor and control your child’s internet use.

With Safes, you can help set screen time limits, block inappropriate content, and monitor online activities. This can provide an extra layer of protection as your child navigates the digital world, including when they use money apps.

You’re welcome to start your Safes free trial. Download Safes from major app distribution platforms like Google Play and App Store.

Also, we have compiled a comprehensive manual detailing how to set parental controls across many devices. Whether your platform of choice is Android, iPhone, Mac, or Windows, our guides are designed to assist you in establishing a more secure digital ecosystem for your household. Please follow the links below to get device-specific guidance:

- Windows parental controls

- Macbook parental controls

- Android parental controls

- iPhone parental controls

Wrap-Up: Kids and Money Management Knowledge

Teaching financial literacy to kids is an investment in their future. With the right tools, such as money apps for kids and practical experiences, you can equip your child with the skills they need to manage their finances effectively and responsibly.

Remember, it’s not just about teaching children to save or invest for their future. It’s about helping them understand the value of money, the impact of their financial decisions, and their ability to achieve financial independence. So, take the time to explore these money apps for kids, engage in open discussions about money, and provide practical experiences to help your child become financially savvy.

- Related Articles:

Your Child’s Online Safety Starts Here

Every parent today needs a solution to manage screen time and keep their child safe online.

Without the right tools, digital risks and excessive screen time can impact children's well-being. Safes helps parents set healthy boundaries, monitor activity, and protect kids from online dangers—all with an easy-to-use app.

Take control of your child’s digital world. Learn more about Safes or download the app to start your free trial today!